Indias Growth Outlook Strong FY25

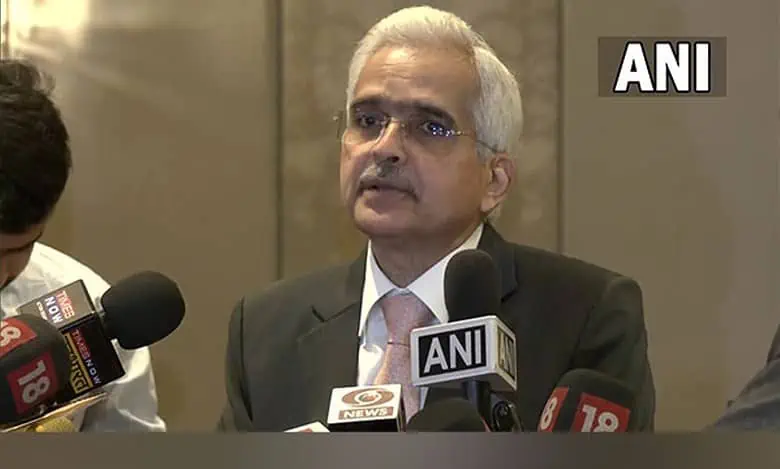

India’s Growth Story Remains Strong: RBI Governor’s Outlook

India’s economic growth remains on a positive trajectory, according to RBI Governor Shaktikanta Das, who highlighted the country’s strong fundamentals in a recent bulletin. He emphasized that India’s real GDP growth for FY 2024-25 is projected at 7.2%. The forecast reflects the resilience of the Indian economy, driven by a combination of robust consumption and investment demand. Despite global uncertainties, India’s real GDP growth FY25 is expected to maintain its upward momentum.

Private Consumption and Investment Drive Economic Growth

The prospects of private consumption, a key pillar of India’s aggregate demand, are looking bright. According to Shaktikanta Das, improved agricultural output and rising rural demand have bolstered consumption levels across the country. The agricultural sector, which forms the backbone of the rural economy, has benefited from favorable conditions, leading to an increase in purchasing power and consumption in rural areas.

Investment activity is also witnessing a positive trend, supported by rising consumer and business confidence. The government’s focus on capital expenditure (capex) and the strong balance sheets of banks and corporates are further fueling this momentum. The India’s real GDP growth FY25 projection takes these factors into account, reflecting the overall optimism in the economy.

Government Spending and Urban Demand to Boost Growth

In addition to private consumption, sustained buoyancy in the services sector is anticipated to support urban demand. The services sector, which has been a major contributor to India’s economic growth, continues to show resilience, driving demand in urban centers. Moreover, government expenditure at both the central and state levels is expected to gain momentum, aligning with the Budget Estimates for the financial year.

The increase in government spending, particularly on infrastructure and development projects, is likely to have a positive ripple effect on other sectors, contributing to India’s real GDP growth FY25. As the government accelerates its expenditure plans, it is expected to create a conducive environment for sustained economic growth.

RBI’s GDP and Inflation Projections for 2024-25

Considering the positive developments in consumption and investment, the RBI has projected India’s real GDP growth for FY 2024-25 at 7.2%. According to the RBI’s projections, the growth rate is expected to be 7.0% in the second quarter (Q2) of FY25, followed by 7.4% in both the third quarter (Q3) and fourth quarter (Q4). The momentum is expected to carry into the next financial year, with a growth forecast of 7.3% for Q1 2025-26.

In terms of inflation, the RBI projects Consumer Price Index (CPI) inflation for FY 2024-25 at 4.5%. The breakdown includes 4.1% for Q2, 4.8% for Q3, and 4.2% for Q4. For Q1 2025-26, the CPI inflation is expected to be around 4.3%. The central bank has emphasized the importance of managing inflation to ensure price stability while supporting growth.

Inflation Concerns: Short-Term Spike Expected

The focus keyword, India’s real GDP growth FY25, is closely tied to inflation management, as price stability is essential for sustainable economic expansion. The RBI has cautioned that CPI inflation for September 2024 may see a temporary spike due to unfavorable base effects and rising food prices. The shortfall in the production of key agricultural commodities like onions, potatoes, and chana dal (gram) has contributed to increased price pressures.

Despite these short-term challenges, the RBI is confident in its ability to steer inflation back towards the 4% target. The Monetary Policy Committee (MPC) has adjusted its stance to ‘neutral,’ focusing on a balanced approach that ensures inflation aligns with long-term targets while supporting the broader economic recovery.

Liquidity Management: A Focus on Stability

Looking ahead, the Reserve Bank of India plans to adopt a flexible approach to liquidity management. Shaktikanta Das noted that the RBI would deploy a mix of tools to manage both short-term and long-term liquidity needs. This strategy aims to ensure that money market interest rates remain stable, contributing to an orderly evolution of the financial system.

The central bank’s commitment to maintaining stable liquidity conditions is crucial for supporting India’s real GDP growth FY25. By using a range of instruments, the RBI aims to smooth out fluctuations in liquidity, thereby creating a stable environment for businesses and consumers alike.

Resilient Growth Amid Global Uncertainty

The India’s real GDP growth FY25 projection of 7.2% underscores the resilience of the Indian economy amidst global uncertainties. Despite challenges such as volatile global markets and geopolitical tensions, India’s growth prospects remain robust. The focus on private consumption, investment, and inflation management positions India to continue its growth trajectory.

The RBI Governor emphasized that the resilient growth outlook allows policymakers to focus on managing inflation effectively. By balancing the twin goals of price stability and economic growth, the RBI aims to ensure a sustainable and balanced economic environment.

Conclusion: Optimism for India’s Economic Future

As India moves into FY 2024-25, the outlook for India’s real GDP growth FY25 remains positive, backed by strong fundamentals. With a focus on consumption, investment, and careful inflation management, the country is well-positioned to achieve its growth targets. The RBI’s proactive measures, combined with favorable economic conditions, offer hope for continued progress in India’s growth story.

Readers are encouraged to stay updated on economic developments, as the RBI’s projections are subject to change based on evolving domestic and global conditions.

Disclaimer:

This content is based on projections and statements made by the Reserve Bank of India (RBI) as of October 2024. The economic outlook is subject to change based on global and domestic economic conditions. Readers should consult official sources for the latest updates.