Retail Investors Surge Despite Market Volatility

Record Highs, Market Volatility Fail to Deter Retail Investors: Surge in SIPs and Demat Accounts

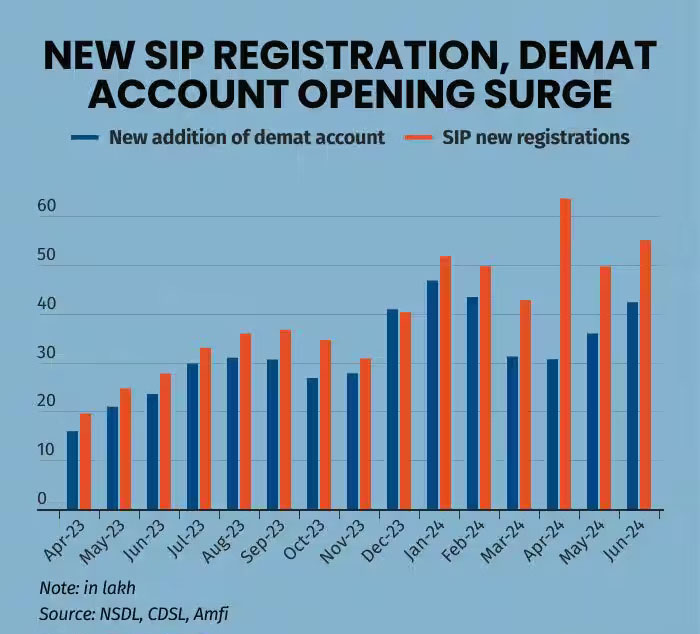

In the first half of 2024, retail investors have shown remarkable resilience, with over 3.3 crore new SIP registrations and more than 2.3 crore new demat accounts being added, despite the market’s volatility and record highs.

A volatile market, hitting new peaks, has not dampened the retail enthusiasm for equities, as evidenced by the surge in Systematic Investment Plan (SIP) registrations and new demat account openings.

Mutual funds witnessed a significant increase in new SIP registrations and account closures between January and June. Industry experts attribute this to mutual fund investors reshuffling their portfolios.

Many investors are transitioning from small and midcap funds to large cap-focused or newly launched schemes, such as defense, multicap, manufacturing, and special opportunities funds, which have recently attracted substantial investments.

In the first half of 2024, there were over 3.13 crore new SIP registrations and more than 1.78 crore account closures. Additionally, over 2.3 crore new demat accounts were added during this period, reflecting the continued robust interest of retail investors in the equity markets.